In this week’s issue, we explore the possible headwinds for multifamily.

This Week’s Top Headlines

- Interest Rates: As expected, the Fed has raised its overnight lending rate by 0.5% — WSJ

- Cap Rates: New analysis says cap rates will continue compressing in 2022 despite rising borrowing costs — Globe St

- Mortgage: Originations are expected to total $2.58 trillion in 2022, a 35.5% year-over-year drop — CNBC

- Sales Profits: Margins on median-priced single-family home sales dropped to 47.2%, the first quarterly decline since late 2019 and the largest in a decade — ATTOM

- Property Taxes: Given the steep rise in housing prices, property taxes are also increasing, creating more affordability concerns — HW

- Competition: Is decreasing for the first time in six months, with 65% of home offers facing competition in March, a drop from 67% in February — Redfin

- Normalization: NAR expects that increased borrowing costs will have a cooling effect on the housing market in the medium-term — HW

Possible Multifamily Headwinds

Main Takeaway: Multifamily sales volume hit $326.8 billion in 2021, close to the $337.2 billion of 2019 and 2020 combined. The strong tailwinds will likely persist in the short-term, however, owners and investors need to account for potential headwinds on the horizon including inflation, migration patterns, and rent and regulatory pressures.

The Story

In all, the multifamily sector outperformed throughout the past few years despite significant economic and social disruption from the pandemic. Although the robustness of this asset class is undeniable, it’s also worth informing ourselves as investors of potential headwinds on the horizon. This week, we will take a closer look at disruptors multifamily owners and investors should be considering.

- Inflation: Although controlled inflation can be positive for real estate, it poses serious challenges to rental real estate should it become more pronounced. Inflation erodes the purchasing power of consumers, and for those who rent, it will put a strain on their ability to pay rent, or pay higher rents. Further geopolitical tensions in Europe could make inflation more sustained and permanent than originally anticipated.

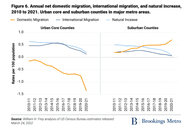

- Migration: Migration to more affordable markets fueled by a sustained remote work culture could place certain markets at risk of price deceleration and lower occupancy. According to a report, Phoenix showed the largest decrease in occupancy (-0.5%) in March, followed by Las Vegas (-0.4%), and Sacramento (-0.3%). According to Brookings, urban core centers suffered the brunt of this outward migration over the past decade.

- Rents: Although asking rents jumped 2.1% in Q1 of 2022, it is unlikely to keep pace with 2021 growth, according to Yardi Matrix. “Economic growth is set to slow as inflation takes hold and the war in Ukraine pushes energy prices up and creates an element of uncertainty.” Further, as millennials enter the family-forming life stage, they will increasingly favor larger single-family homes over multifamily.

- Regulatory Pressure: One headwind for the rental sector is the ongoing regulatory and political response to a desire for more supply and affordability by policymakers. This is not to say affordability isn’t a serious problem that deserves immediate attention, it certainly is. What is a potential risk to multifamily investors however is reactionary political and regulatory moves to ostensibly help improve affordability that could be counterproductive. This could include mandatory affordability metrics, rent controls, pushback again investor activity, NIMBYism, and more.

Expert Take

“The single-family rental concept is not new, but it has been blossoming over the last several years and most notable since the onset of COVID-19. That is when we really saw things picking up…With “While the multifamily market posts healthy fundamentals, above-trend inflation, rising interest rates and the war in Ukraine raise concerns. The Federal Reserve is trying to keep inflation under control by increasing the interest rate—the 10-year U.S. Treasury rate yielded 2.4% in late March, which is the highest it’s been in the last three years and will likely continue to grow. This comes at a time when multifamily acquisition yields are at all-time lows—averaging 4.5% and lowering to the 3% range for assets in prime locations or with high revenue streams—which can complicate transactions and refinancings.”— Anca Gagiuc, Yardi Matrix

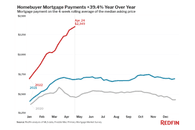

Chart: Mortgage Payments

According to Redfin, homebuyer mortgage payments have increased dramatically in 2022.