In this week’s issue, we explore a recent White House announcement.

Weekly Insights

We start off with the week’s multifamily insights and then dig deeper into what a recent White House announcement means for the multifamily market. Let’s start with the top multifamily stories from this week.

- Leases: Multifamily lease renewals hit an all-time high of 57.4% in Q2 2020, and then another at 57.6% in Q3 2021, and have now set another record of 58.3% in Q1 2022 — MHN

- Investors: Spent $63 billion on apartment buildings in Q1 2022, the highest figure on record, but they’re getting worried about rising rates — WSJ

- Rates: And those rising interest rates are driving up capitalization rates across all commercial real estate — Business Times

- Rents: Rising borrowing costs also have investors worried about whether the pace of rent can keep up — Bisnow

- Still Growing: The multifamily market grew 1.3% in April MoM, suggesting a 16.8% annual growth rate — Globe St

- Construction: The multifamily markets with the most building are split between Sun Belt metros and northern metros. Austin took the top spot, with 26.1 multifamily building permits per 10,000 people in Q1, followed by Jacksonville (19.9), Salt Lake City (16.7), Orlando (12.7), and Denver (12.6) — Redfin

- Suburbs: Are leading the pack for most popular real estate markets with Woodinville, Washington, leading the pack followed by Burke, Virginia, and Highlands Ranch, Colorado — Zillow

Housing Plan

Main Takeaway: The White House’s new housing initiative could serve to dramatically increase the supply of smaller multifamily units and manufactured homes as well as reduce barriers to multifamily construction of all types.

Story: On May 16, the White House released its new Biden-Harris Administration Housing Supply Action Plan aimed at helping improve the supply and affordability gaps. Here are the key components of the proposal:

- Reward jurisdictions that have reformed zoning and land-use policies with more grants.

- Deploy new financing mechanisms for manufactured housing, accessory dwelling units (ADUs), 2-4 unit properties, and smaller multifamily buildings.

- Expand and improve existing forms of federal financing, including for affordable multifamily development and preservation including making construction to permanent loans more widely available by exploring the feasibility of Fannie Mae purchasing these loans.

- Work with the private sector to address supply chain challenges and improve building techniques to finish construction in 2022 on the most new homes in any year since 2006.

This is certainly an ambitious plan. Here’s a further breakdown of the first two points and how they will impact the multifamily market and investors.

1. Zoning

One of the biggest obstacles to increasing supply, and therefore affordability, is draconian and restrictive zoning regulations. This includes an over-reliance on single-family zoning, setbacks, height restrictions, parking minimums, and an expensive and drawn-out rezoning process.

Extended rezoning and site planning processes that take years add to the holding costs for developers. All of these factors add costs to the construction lifecycle, driving up prices, and ultimately put downward pressure on owner and renter affordability.

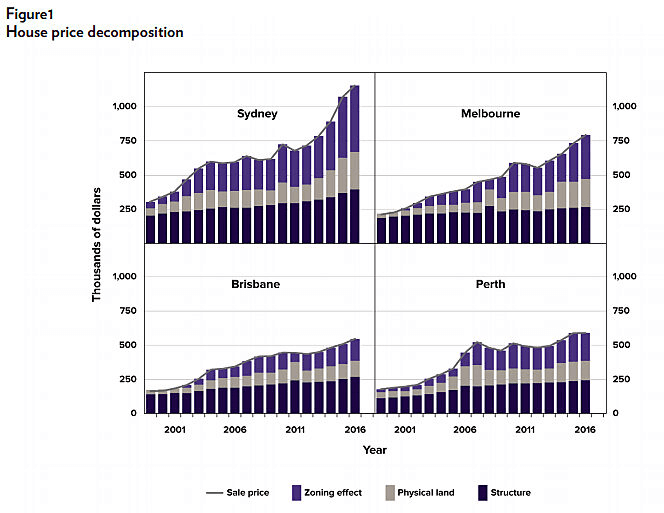

Take for instance an interesting Cato Institute study that looked at the pricing effect zoning red tape had on housing development.

In short, the regulatory burden of zoning and site planning has a dramatic impact on overall costs. Reducing this, as the White House is proposing, will have a positive impact on the multifamily market.

2. Small Multifamily

Further enabling gentle densification across the U.S. with ADUs, manufactured homes, and small missing middle multifamily will also have a positive impact on the industry.

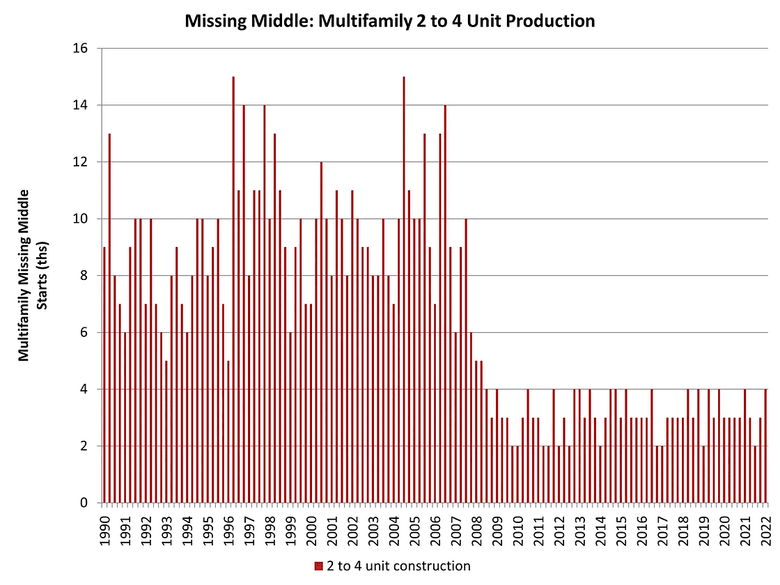

According to a recent NAHB analysis, “the multifamily segment of the missing middle (apartments in 2 to 4 unit properties) has disappointed. For 2021, there were only 12,000 starts of such residences. This is flat from 2020, during a period of time when most market segments expanded.”

Adding new financing mechanisms, as the White House is proposing, alongside reducing zoning friction will dramatically open up this niche and under-supplied multifamily market. Barriers to entry for smaller-scale investors will also be removed and open up supply generally. This will put downward pressure on both construction costs and prices, bringing more balance to our market.

If Fannie and Freddie are further enabled to not only back, but purchase loans related to small multifamily and manufactured homes then this market will become even more attractive to investors.

Indeed, according to the White House: “Financing for these housing types has the potential to boost supply in constrained markets, and create location-efficient, modest density that can improve labor market outcomes and reduce greenhouse gas emissions – particularly when paired with state and local policies that remove barriers to where these kinds of housing can be located.”

Expert Take

“Higher levels of manufactured housing and affordable rental construction could provide some relief, as occupancy rates across residential segments are historically high. Entering the second quarter, Class C apartment vacancy stood at just 2.0 percent, halving the pre-pandemic equivalent. Meanwhile, manufactured housing availability declined between 2019 and 2021 in 99 of 143 metros, bringing the national rate down to 6.1 percent last year. Greater development will likely not hinder metrics, but rather help alleviate the backlog of demand.” — Marcus & Millichap Research Services

“With the housing plan, the Biden administration is laying the groundwork for a rise in “gentle density,” meaning the kinds of homes that add to the supply of low-cost housing without triggering opposition from neighbors.” — Kriston Capps, Bloomberg

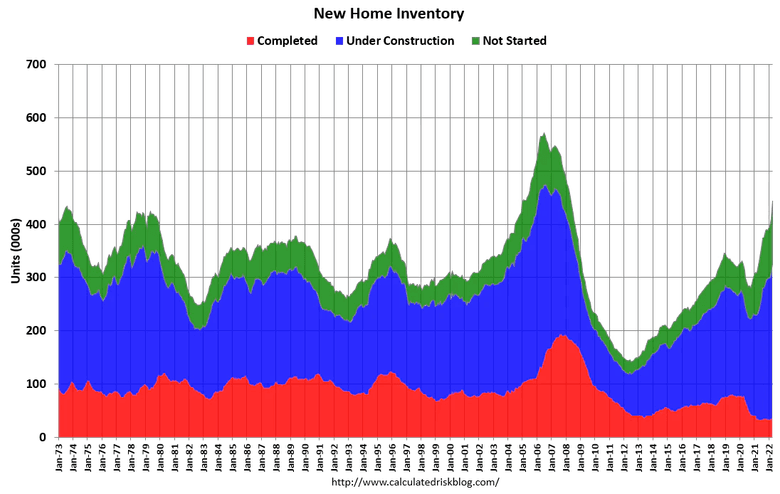

Chart: Home Inventory

According to Calculated Risk, housing inventory is steadily rising with the months of supply increasing in April to 9 months, up from 6.9 in March.