In this week’s issue, we explore the current state of construction and its impact on multifamily.

Weekly Insights

We start off with the week’s multifamily insights and then dig deeper into construction data and what it means for multifamily owners and investors. Let’s start with the top multifamily stories from this week.

- Price Growth: Although home prices continue to increase, there is a deceleration in growth — CNBC

- More Price Growth: Home price growth will continue into 2023 but consumer spending will slow— Fannie Mae

- STRs: Demand for vacation home mortgages has fallen below the pre-pandemic baseline, down 4% in May — Redfin

- Flippers: 1 in 10 real estate transactions were attributed to house flippers, the highest rate since 2000 — ATTOM Data Solutions

- Sentiment Drops: Freddie Mac’s Multifamily Apartment Investment Market Index (AIMI) declined by 5.3% QoQ and was down 6.1% YoY — MPA

- Delinquency Lows: Despite rising rates, mortgage delinquency rates dropped to another record low of 2.75% in May 2022 — MPA

- Bidding Wars: The hot rental market is forcing a new type of bidding war, between renters — MarketWatch

- But: According to new data, rents rose only 1.3% in June, at a slower pace than 2021 — Apartment List

Apartment Construction

Main Takeaway: The pace of apartment construction is the highest since the 1980s, pointing to higher future supply amidst a backdrop of rising interest rates, slowing rent growth, and inflationary pressures. Look for demand in the lower to moderate-income demographics to be the strongest in the coming years as rent growth overall moderates.

Story: The Joint Center for Housing Studies of Harvard University recently released its annual report, The State of the Nation’s Housing 2022. A large segment of the report is focused on apartment construction, here are a few key takeaways for context:

- 2021 saw the highest starts of multifamily (474,000) since the mid-1980s.

- Of those starts, 88% were in buildings with 20+ units.

- This rapid pace continued in 2022, with starts totaling 124,000 in Q1, the highest first-quarter reading since 1986.

- This new construction is almost entirely centered around the upper end of the market.

- The share of new rental units under 1,000 square feet declined from 45% in 2000 to 37% in 2020.

- The share of units that were over 1,400 square feet rose from 9% to 12% during the same timeframe.

In sum, we are adding a lot of newer, nicer, and bigger rental stock to our multifamily ecosystem. But, even at the current elevated growth pace, completions of new rental projects have not yet caught up with record-breaking demand.

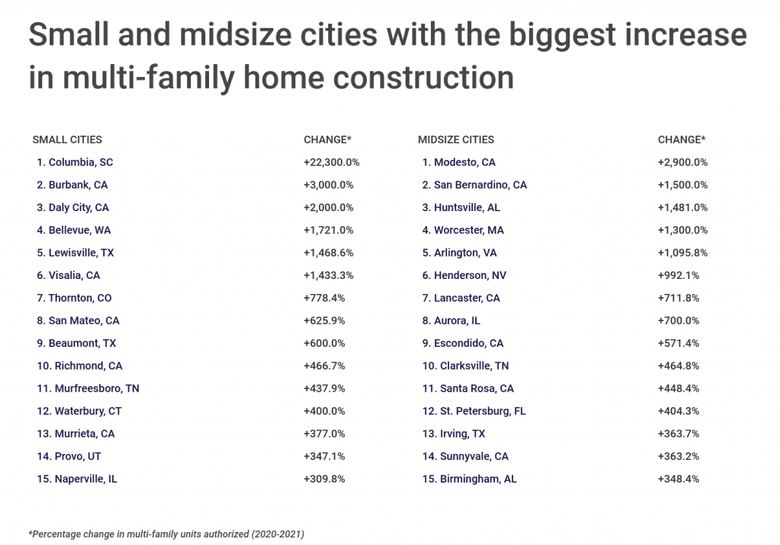

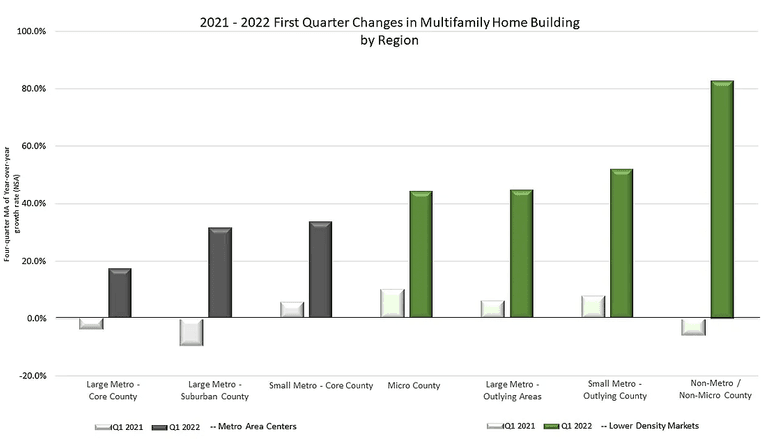

According to Lattice Publishing which released a new report on multifamily construction, all types of markets saw construction growth between 2020 and 2021.

“In New York, multi-family units represented 72.3% of all new units authorized in 2021, and in neighboring Massachusetts, New Jersey, and Pennsylvania, multi-family units represented more than 60% of total authorized units…But others are seeing sharp increases in the rate of multi-family authorizations simply because such housing is rare. For example, Louisville experienced a nation-leading 1,506.9% jump in the number of multi-family units authorized from 2020 to 2021.”

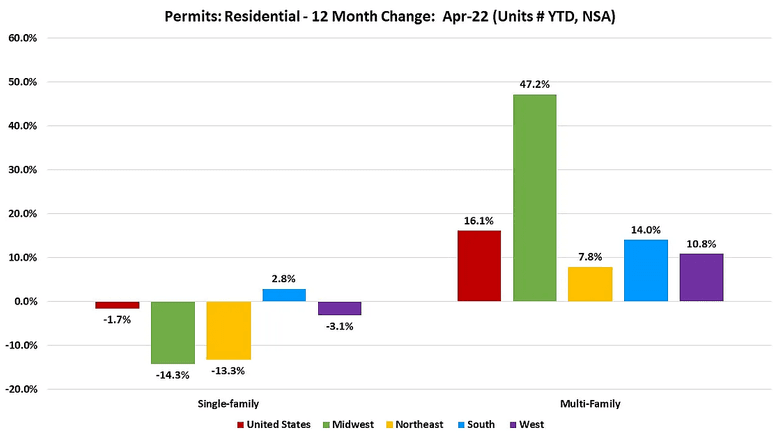

Looking at permit data, more multifamily supply is on the horizon and is far out-pacing single-family home construction (more data on this below).

This is why single-family homebuilder sentiment is dropping sharply, to 67 last month, down from 90 at the end of 2020. Indeed, single-family home construction actually fell 14% in May, and applications to build (a proxy for future construction) fell to 1.7 million units, the lowest since September 2021.

Will the apartment construction sector be next?

Always Headwinds

Rent growth is decelerating. According to a new report from Apartment List, “[o]ver the first half of 2022, rents have increased by a total of 5.4 percent, compared to an increase of 8.8 percent over the same months of 2021.” This coupled with increased inflation and Fannie Mae predicting a slowdown in consumer spending, shows there are headwinds ahead for multifamily owners, particularly in the higher end of the rental market.

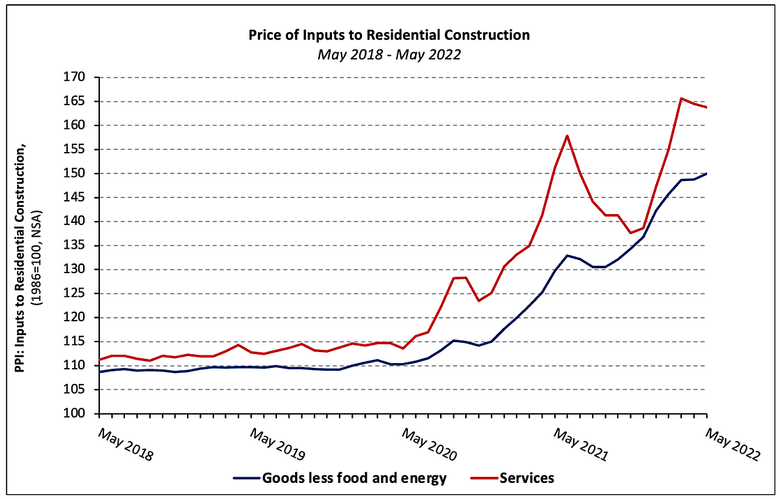

Also, we need to keep in mind that construction financing has become much more expensive, and construction inputs are up dramatically. According to one study, construction materials overall increased a staggering 21% year-over-year, and 40.4% since January 2020.

Given all this, it’s no surprise that multifamily housing start data from May showed a decrease of 10% MoM.

Expert Take: “Class A housing may be able to command continued rent growth from consumers with higher incomes. Whether that might be true for Class B or C housing, where consumers are likely to have more constrained financial resources, is far from clear.” — Erik Sherman, Globe St

Chart: Outpacing SFHs

According to NAHB, apartment construction far outpaced that of single-family homes, and showed strong growth in smaller markets.