Main Takeaway: Despite rapid rent growth throughout the pandemic, multifamily investors and owners are increasingly in the red due to higher debt costs, tightening credit options, inflation-fueled expenses, higher insurance costs, and increased property taxes.

Story: According to Mayra Rodriguez Valladares of Forbes, the banking crisis is over. We are entering a period of rating downgrades of many banks as they struggle with higher interest rates and consumer deposit risk. Smaller banks with less than $100B in assets have a much stronger exposure to commercial real estate than larger ones.

According to Johannes Moller, Director at Fitch Ratings: “U.S. regional and small banks with meaningful commercial real estate concentrations could experience negative rating pressure if portfolios deteriorate, particularly those with more exposure to office markets constrained by weaker occupancy…most concentrated CRE exposure is held on balance sheets of smaller banks which are not rated by Fitch, limiting our visibility into lender-level credit quality for the broader ~4,700 banks in the U.S.”

For multifamily owners, this means potential pain ahead regarding your debt. According to data from Trepp, “[d]ebt payments already exceed income from multifamily buildings financed with more than $47 billion of securitized loans.”

Joe Gose of Propmodo expands on the coming headwinds for multifamily loans using Trepp data. Gose reports that of the $87.7B in at-risk commercial loans (below a debt service ratio of 1.25) that are maturing over the next 2 years, $37B belong to the multifamily asset class. Further, “$23.5 billion of those apartment loans have a debt service coverage of less than 1, or insufficient cash flow to pay the mortgage.”

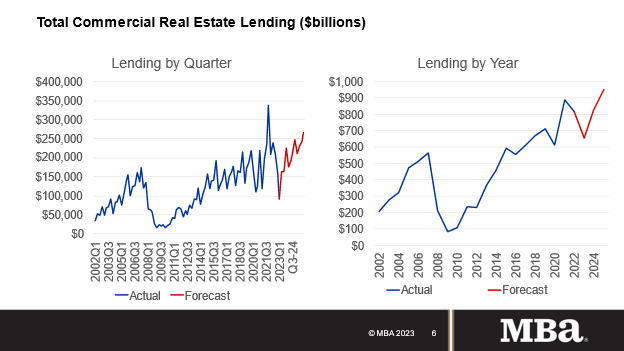

Putting a finer point on the issue, Moody’s Analytics estimates that $235 billion in multifamily loans will come due in 2023 and 2024. And in a recent forecast, MBA estimates that multifamily lending will drop by 14% to $375 billion in 2023, before rising again in late 2024.

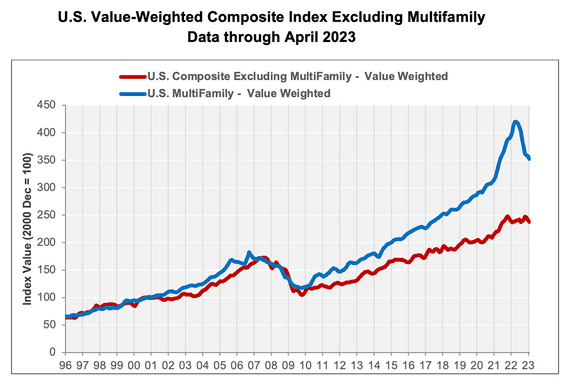

Ultimately this means price declines, which the market is already experiencing, according to CoStar. Double-digit annual price declines had not occurred in the multifamily sector since the Great Recession but began resurfacing in April 2023. The following chart shows the price declines of both multifamily (blue) and commercial real estate (red).

“Transaction activity fell to $5.3 billion in April 2023, a 44.1% collapse from the prior month. Investment grade transaction volume tumbled by 49.3% over the prior month in April 2023 to $2.7 billion, while the general commercial segment fared better, dropping 37.2% from the prior month to $2.5 billion.”

Year-over-year, multifamily sales fell by an astonishing 74% in Q1 2023.

As values fall and credit conditions tighten, owners and investors will be increasingly squeezed and forced into a distressed sale situation. That said, CoStar notes that distressed sales are still at record lows, which also means that we may not yet have seen the bottom of the market drop.

Location data analytics firm Markerr noted in an NMHC conference earlier this year that investors anticipate distressed opportunities coming online in the second half of 2023.

We’re already seeing absorption rates declining, according to NAHB:

“Data from the Census Bureau’s latest Survey of Market Absorptions of New Multifamily Units (SOMA) indicates that multifamily market demand has softened as the percentage of apartments absorbed within the first 3 months of completion fell to 59.0% after six consecutive quarters of above 60.0% percent absorption.”

Expert Take on Multifamily Loans

“For now, the fallout has been limited. That’s because investors often purchase rate caps that protect them from the worst effects of soaring interest costs. But those policies are likely to begin burning off at a rapid rate later this year, leaving a growing number of owners vulnerable.” — Patrick Clark and Prashant Gopal, Bloomberg

“Now multifamily experts are bracing for distress as borrowers in these so-called negative-leverage deals, in which the cost of debt exceeds the investor’s initial yield on an acquisition, could face difficulties, and not only in making mortgage payments. Refinancing or selling the assets in a higher interest rate environment is also difficult, casting uncertainty over property values.” — Joe Gose, Propmodo