The Story

Modular multifamily construction—where construction happens primarily off-site—is growing rapidly. One forecast shows that modular construction generally will be a USD $114.78 billion industry by 2028, with a compound annual growth rate (CAGR) of 6.1% between 2021-2028. In 2020 the modular construction industry was valued at $72.11 billion. Another estimate states that this industry will grow faster, to $160 billion by 2023.

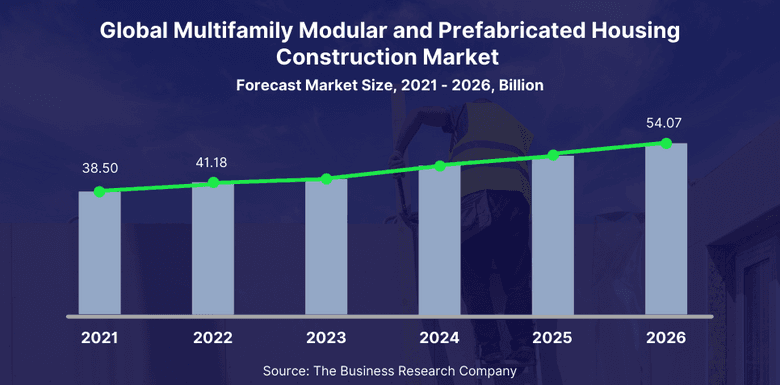

Specific to multifamily, the global multifamily modular and prefabricated housing construction market is estimated to grow from $38.50 billion in 2021, to $41.18 billion this year alone at a CAGR of 7.0%.

Regardless of the numbers, multifamily owners and investors should familiarize themselves with this trend. Here are some key points.

1. Modular can accelerate development time by up to 50%

Modular projects have a track record of accelerating timelines by anywhere from 20–50%. In construction, time is money. According to a 2020 report, “[a]bout 90% [of builders] report that they achieve improved productivity, improved quality and increased schedule certainty when using these methods compared to traditional stick-built construction.”

2. Modular can save 20% on construction costs

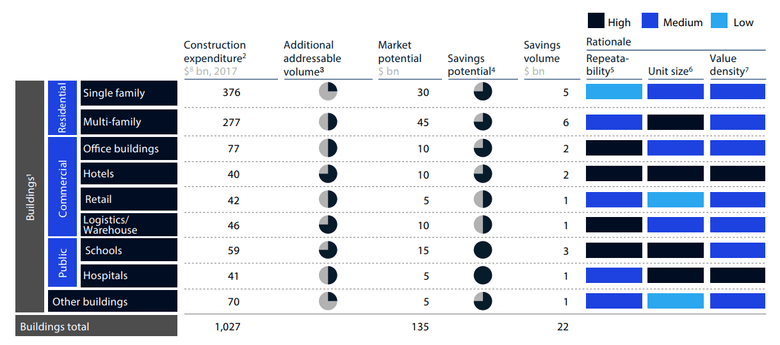

Builders can save 20% or more in construction costs through modular construction. For multifamily specifically, according to McKinsey, the savings of modular construction is the highest for all construction verticals, sitting at $6 billion in savings figure for the year they studied (2017).

3. Hedge against labor shortage

As labor shortages and retirements continue to slow down the construction industry as a whole, investing in modular can be seen as a hedge against these labor headwinds.

4. Competitive advantage through automation

As manufacturing and construction technology continues to automate, the reality is that multifamily builders who are early modular adopters will likely have a competitive advantage to those relying solely on traditional construction methods.

5. Adapting to a pandemic world

According to a recent report the growth in global multifamily modular and prefabricated housing construction “is mainly due to the companies resuming their operations and adapting to the new normal while recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges.”

6. Less waste

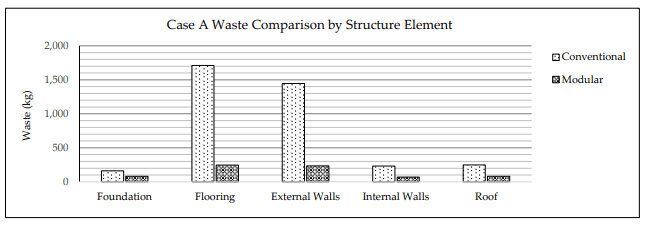

Because modular construction occurs in an off-site controlled environment, it significantly reduces material wastage as well as the environmental strain on the site and neighborhood. A 2021 study found: “Overall, modular construction reduces the overall weight of waste by up to 83.2%, for the cases considered. This corresponds to a 47.9% decrease in the cost of waste for large structures.” In studying a modular granny flat in Australia, this study found the following waste reduction compared to traditional construction.

Expert Take

“Modular construction represents a paradigm shift that involves the entire supply chain—which we refer to as the technology ecosystem—that greatly impacts factors such as sequence and process of design and construction holistically, rather than serve as an alternative construction type.” — Jeffrey Schoeneck, principal executive director – LIVE at Cuningham

So What?

With the ongoing adoption of advanced manufacturing technology, digitization, and the current supply chain challenges faced by builders, expect modular construction to further permeate our industry. There may come a time when mass adoption of modular becomes a reality, and now is the time for us to take a strategic assessment of the impact and viability of modular thinking in our businesses.

This Week’s Top Headlines

- Multifamily values are increasing faster in smaller markets and suburbs – WMRE

- Despite builder confidence being high, all developers struggle to finish projects — Housing Wire

- Mortgage applications dropped 13.1% last week, the lowest level seen since December 2019 — CNBC

- Austin-based construction startup Icon raised $185 million to expand its 3D home business — TRD

- Housing inventory dropped under 1 million in December 2021, 41% lower than in 2019 — Yahoo! News

- Federal officials say at least half of Freddie and Fannie’s lending in 2022 will have to be “mission-driven” (more workforce housing properties and fewer luxury buildings) — WMRE

Weekly Chart

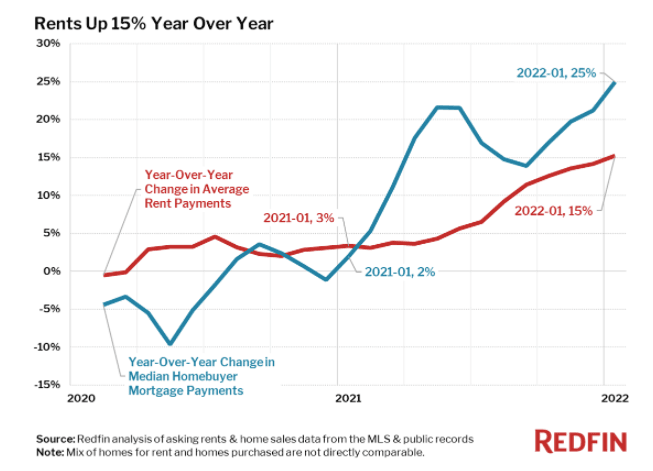

According to Redfin, average monthly rents rose 15% year-over-year in January to $1,891.