In this week’s issue, we explore the current state of multifamily demand.

This Week’s Top Headlines

We start off with the week’s multifamily insights, and then dig deeper into the demand for multifamily housing. Let’s start with the top multifamily stories from this week.

- Foreign Investment: Record-breaking multifamily fundamentals are attracting international capital — Globe St

- Amenities: Both a shower stall and tub ranked as the most important bathroom amenity in a consumer survey — NAHB

- Flippers: Single-family homes and condos flipping in the U.S. is up 26% from 2020, the highest point since 2006 — ATTOM

- Rates: Year-over-year fewer people are searching for homes online and applying for mortgages — Redfin

- Green = Green: LEED-certified multifamily properties are getting higher rents, sitting at an average premium of 3.6% — Globe St

- Florida Rising: Rents in Florida are skyrocketing, with Naples jumping 38.4%, Sarasota 33.2%, and Fort Myers 30.9% — Business Observer

- Delays: 85% of builders are reporting delays in either construction or permitting — Globe St

The Story

Demand for multifamily assets is at record levels. This means record equity levels in multifamily assets, but has some experts questioning if these growth levels can continue in the medium term. Key takeaways:

- Market-rate apartment demand broke records, with net demand sitting at 673,000, 66% above the previous record set in 2000.

- Asking rents were up almost 12% by the end of 2021, compared to the same period in 2020.

- National median rent sat at $1,333 in March, a month-over-month increase of 0.8%, and a 17.1% year-over-year jump.

- Multifamily construction starts set a record-high of 734,000 units by the end of 2021, the fastest pace since 1974.

- Multifamily investors are moving back to large metros and urban centers, with investors spending $32.2 billion on high and mid-rise apartment properties in Q3 of 2021, up from $8.9 billion in Q3 2020.

- But farther from cities, demand is still strong for apartment rentals. CoStar reports that in Q4 2021, rural and small towns saw the largest increase in multifamily growth.

- Finally, apartment occupancy rose 2.1 basis points year-over-year to, currently sitting at 97.5%. There just isn’t enough housing to meet current market demand.

Expert Take

“Multifamily starts have been robust over the last decade and stalled only briefly when the pandemic first hit before re-accelerating again…Starts in 2022 will likely top 2021 levels, meaning completions should remain very high through at least 2023-2024. That’s especially true in many of the nation’s Sun Belt metros, most notably D/FW, Austin, Phoenix and Nashville.”— Carl Whitaker, RealPage’s Director of Research and Analysis

So What?

Demand for apartment housing continues to outstrip supply, however, there is supply on the horizon with new construction picking up. That said, the supply chain issues exacerbated by the pandemic and war in Europe will likely hinder the construction cycle in the short term. It appears we are going to see status quo on the strong multifamily demand side for the foreseeable future. Although rents may flatten, demand will continue to be robust.

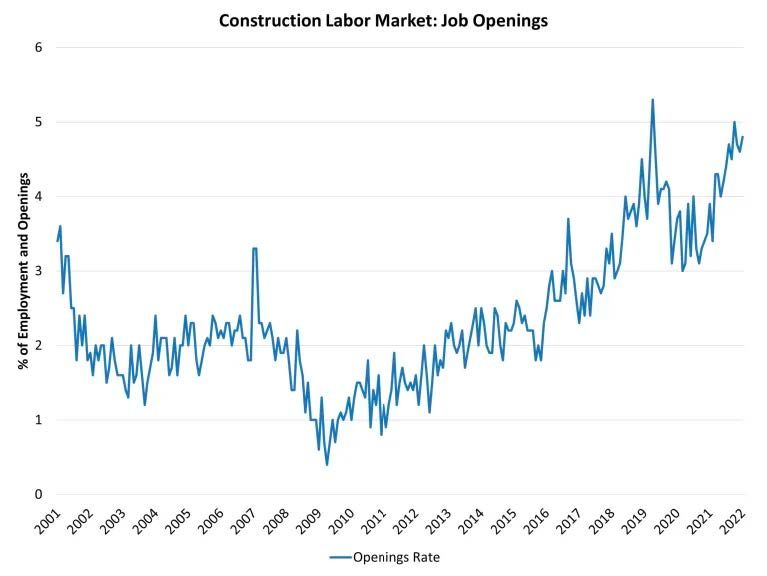

Weekly Chart: Construction Jobs

According to NAHB, construction hiring remained flat in February, with 381,000 unfilled positions. The highest measure in data history was 416,000 in April 2019 at the height of the pandemic.