In this week’s newsletter, we delve into Freddie Mac’s new annual multifamily outlook report.

The Story

Freddie Mac released its 2022 Multifamily Outlook report this week. We’ve read through the entire report so you don’t have to, here are some of the key takeaways for multifamily owners:

- Multifamily origination volume will continue growing to $475 – $500 billion in 2022.

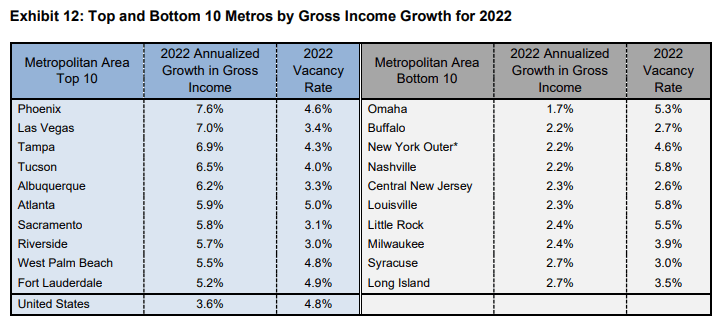

- Rent growth will continue in all markets in 2022, with the Sun Belt markets outperforming others.

- Rents in the Northeast and Midwest markets will grow at a lower rate.

- Growth will moderate in 2022 due to concerns about inflation and COVID-19 variants.

- Forecast a gross income growth of 3.6%, with vacancy rates to remain flat at 4.8%.

- By 2030, sole-person households are expected to increase from 36.1 million to 41.2.

- The markets with the highest projected rent growth are Phoenix (8.2%), Tampa (7.7%), Las Vegas (7.4%), Tucson (7.1%).

Expert Take

“We believe the market will continue to grow in 2022, reflecting the strong multifamily fundamentals that drove the market to a record-breaking year in 2021…We anticipate rent growth in all markets in 2022 due to strong demand driven by improving economic conditions.” — Steve Guggenmos, Vice President of Multifamily Research & Modeling at Freddie Mac.

So What? The multifamily market is one of the strongest asset classes coming out of 2021 despite concerns around unpaid rent, the labor market, and eviction moratoriums. Expect 2022 to remain a solid year for multifamily, albeit less eventful than 2021.

The primary threat to multifamily investors is runaway inflation. If wages cannot keep up with staggering increases in inflation, this will downward pressure on rents and upward pressure on vacancies in certain multifamily asset types.

This Week’s Top Headlines

- Between March 2020 and December 2021, asking rents in the top 30 U.S. metros rose by an average of $194, or 13.5%. — MHN

- Multifamily technology trends in 2022: Construction tech, smart home, and ESG-related tech are the top three trends for the new year. — MFE

- Fresh off an awkward departure from WeWork where much of the investor criticism centered around the co-working space’s business model not owning the physical real estate, Adam Neumann is now becoming an apartment magnate. — Bisnow

- 77.1% of multifamily rents were collected as of Dec. 6, up from 75.4% during the same time in 2020. — NMHC

- According to Yardi Matrix data, despite rents increasing 13.5% year-over-year, 2022 growth is expected to decelerate. — MFE

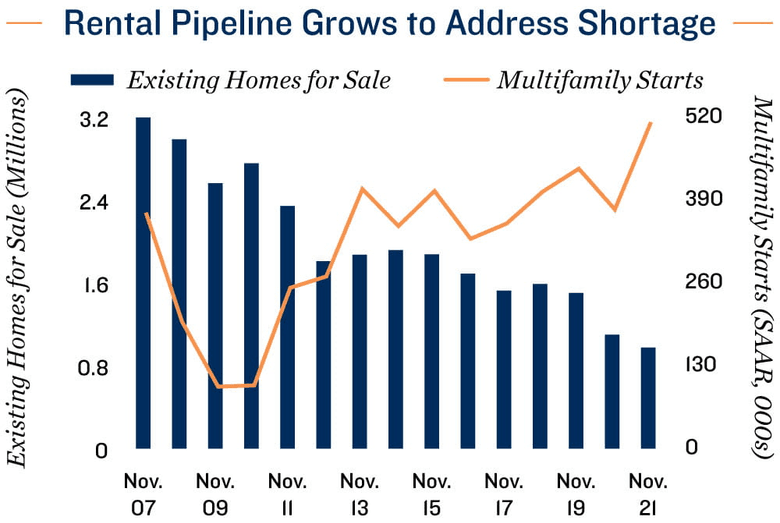

Weekly Chart

Nationally, roughly 400,000 new rentals will be added in 2022, a massive number that “is a record spanning back multiple decades.” — Marcus & Millichap